Newspaper revenue in Europe: the causes of the decline in recent years

The relationship between Google and editorial publications has always been rather stormy, especially in Western Europe, since – among other accusations and rather simplifying it all – the media believe that the search engine takes advantage too freely of their content to be shown in the SERP, thus causing a reduction in readers, and which can also in some way systematically penalize the positioning of some content to favor others (as stated a few months ago by the Daily Mail). The underlying thesis is that Google is responsible for the sharp drop in revenues of European newspapers that has occurred in recent years, but a search by Accenture (commissioned by Google) seeks to clarify the real causes of this phenomenon.

Accusations to Google by the news industry

The loss of advertising revenue in the digital age has been a constant theme for over twenty years around the world and a large part of the so-called news industry tends to blame companies like Google and Facebook for this contraction.

Although “revenues from digital readers are growing at a promising pace, there is no doubt that the publishers’ business model has been questioned in recent decades,” writes Eero Korhonen, Head of News and Publisher Partnerships, Google in Europe, Middle East and Africa. For this reason, some critics have argued that “if Google and Facebook did not exist, much of the printed newspaper revenue would remain with news publishers”, accusing these technological platforms of having directly “shattered the newspaper business model”.

The study on the newspaper revenue decline

To “defend itself” from the accusations, Google commissioned a detailed report to Accenture, which basically “examines the facts that disprove this theory“, analyzing examines the revenues of newspapers in Western Europe in nearly two decades to reveal exactly what “broke the old business model for publishers”.

The countries included for the analysis in this report are Austria, Belgium, Denmark, Finland, France, Germany, Greece, Ireland, Italy, the Netherlands, Norway, Portugal, Spain, Sweden, Switzerland and the United Kingdom, chosen on the basis of the availability of solid data.

The results of Accenture’s economists’ work “speaks for itself: almost half of the overall decline in newspaper revenue is not the result of Google Search or social media advertising, but of the loss of newspaper ads in favour of specialised online operators”.

Internet and changes in news consumption

Over the past two decades, we’re seeing the strong impact the Internet is having on how we create and consume news: people spend more time online, and as a result, journalists and newspaper publishers are increasingly turning to technology to find new ways to reach readers and increase subscriptions.

Inevitably, the news industry is changing, proposing solutions such as subscriptions, data analytics, use of artificial intelligence or new formats.

Readers pay more and more for digital news

According to updated data, at least four out of five people today access online news: although “many readers do not have the habit of paying to access the news, between 2013 and 2018 digital circulation volumes increased by 307% to reach 31.5 million paying subscribers globally, more than offsetting the decline in paid paper subscriptions“. Since 2018, the pace with which publishers launch digital subscription models is further accelerated, “which is a promising signal,” says Korhonen.

Where the issue of newspaper revenue arises

However, the growth of online revenues alone was not sufficient to offset the loss of printed advertising.

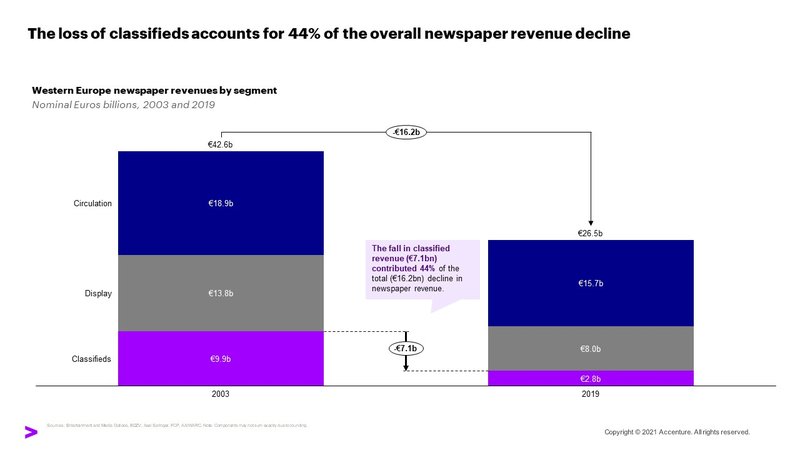

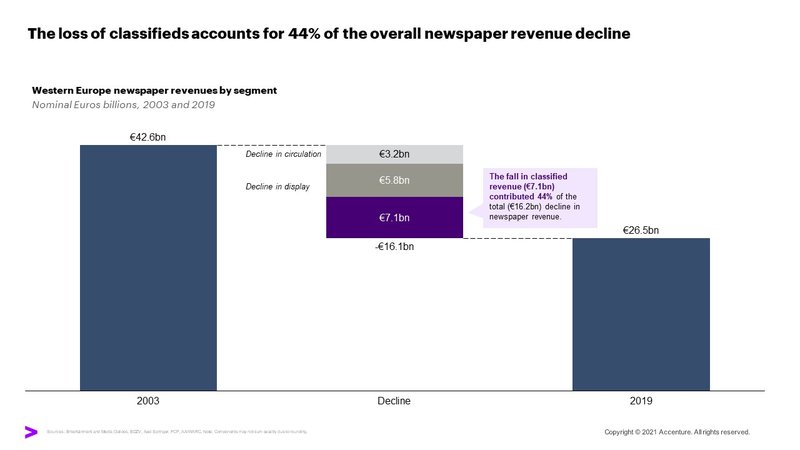

As people “moved online, regular display advertising in newspapers became less popular, with revenues in this segment falling from 13.8 billion euros to 8 billion euros between 2003 and 2019 in Western Europe”.

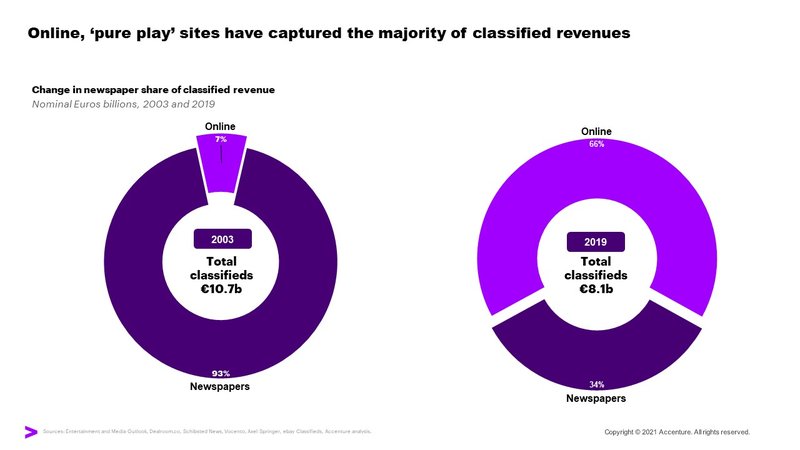

Most of the advertisements in the newspapers consisted of advertisements such as selling cars and homes, or lists of jobs and birth and death notices. These advertisements “contributed 9.9 billion euros – almost a quarter – to the revenues of newspapers, and newspapers raised 93% of all advertising of this type in 2003″.

However, reaching 2019, “only 32% of such revenue went to newspapers, generating just 2.8 billion euros”: this fact represented “44% of the decline in total newspaper revenue over the period”.

This change was driven by the emergence of a large number of digital-only sites, such as Scout24 and Rightmove for real estate; Totaljobs for Jobs and Mobile.de, Automobile.it, Bilbasen and Motors.co.uk for cars. Many of these were previously owned by newspaper publishers or media groups (and therefore, some of the newspapers complaining of loss of revenue from advertisements are still earning or selling their ad business).

In practice, according to the study, Western European newspapers have lost their ad revenue to niche classified sites, which have targeted specific verticals. As they are often owned by the same editorial publications, therefore, the study implicitly suggests that some of the blame for the loss of ad revenue is attributable to the actions of these same publishing groups.

The impact of online advertising

This is not the only thing that has changed, of course: in the same period, we have seen “the transformative development of research platforms and social media“. In turn, the value of online advertising grew significantly from €2.2 billion in 2003 to €50.5 billion in 2019, along with growth in all advertising sectors.

Accenture’s (and Google’s) study, however, points out that this “did not happen at the expense of newspaper revenues“.

Indeed, research “shows that advertising on the Internet as a whole has developed mainly with new opportunities”. Online advertising is one way “completely new for advertisers to connect with their customers: among other things, it created a scalable and economic opportunity for small and medium-sized businesses to reach consumers in a way they could not previously afford and, of course, for newspapers to place online ads along with their content”.

Implications for newspapers

What research also shows is that the Internet has not caused (only) damage to these companies, but has actually brought benefits.

Today we spend more time than ever consuming news, and “there are many new innovative publishers who would have struggled to catch on at the time of the press”; not only that, there are “green shoots of growth even among traditional newspapers“.

Korhonen cites two cases in particular: here in Italy, GEDI (the publishing giant that publishes, among other things, the Republic, L’Espresso, La Stampa, Il Secolo XIX, several local newspapers, and then also periodicals, online newspapers and information sites, including Huffpost Italia) has “implemented a data strategy to improve reader engagement, increase subscriptions and generate revenue from advertisers”; in Sweden, “Dagens Nyheter uses three different paywall strategies to convert readers into paid subscribers, which reduced the number of people who cancelled their subscription from 15% to 8% in just two years”.

In conclusion, therefore, Google is not only not responsible – data at hand – for the fall in publishing revenue, but “is contributing significantly” to the growth of readers and revenues. Over the past 20 years, the American company “has worked closely with the news industry and is one of the world’s largest financial supporters of journalism” providing billions of dollars to support the creation of quality journalism in the digital age“, as also demonstrated by the recent development of Google News Showcase.

What is the true role of Google in the newspaper crisis?

As noted by some commentators, such as Roger Montti, in fact this study of Accenture addresses the problem of the decline in newspaper revenues from a rather obvious starting position (also seen by the Google commission), and in particular does not shed light on some critical aspects related to the role of the search engine or its Google Ads system for online ads – which, as we know, provides fees for variable ads (and criticized).

Furthermore, the report makes no mention of how different, and probably higher, Western European media revenues and revenues would be if Google did not enjoy a dominant position in online advertising, nor does it shed light on the amount of revenue withheld by Google.

In this sense, as has emerged in the various legal disputes involving Google for the management of its advertising system or for copyright, we can quote a piece of data revealed by the Australian Competition and Consumer Commission (ACCC, a regulator of the market in Australia) that has defined Google and Facebook technology monopolies that leave little negotiating power to publishers: in 2018, for every 100 Australian dollars spent by Australian advertisers, a share of 49 dollars went to Google while 24 dollars went to Facebook.

As in any case that sees two opposing factions, ultimately, this story has more sides and aspects to investigate: we will see if the world of the news industry will reply to Google by providing its estimates of revenue declines.