Ads online, Amazon undermines Google in the USA

It is too soon to talk about cracks, but some hints of earthquake are certainly there: for the first time in years, in the US market Google is not reinforcing its position of absolute monopoly toward investments on online advertisement, and is actually closing on a losing curve against juggernauts such as Amazon and Facebook, that recently won the attention of advertisers overseas.

USA market, it is a daring match between Google and Amazon on ads

To unveil the news here comes a study by eMarketer, an american company specialized on digital researches, that pictured the ongoing situation of the US market of online ads, highlighting how competitors are undermining Google’s position. The distance keeps on being huge, anyhow, but as we were saying it has been years since last time the Mountain View company closed on a losing trend.

Google’s adverts results

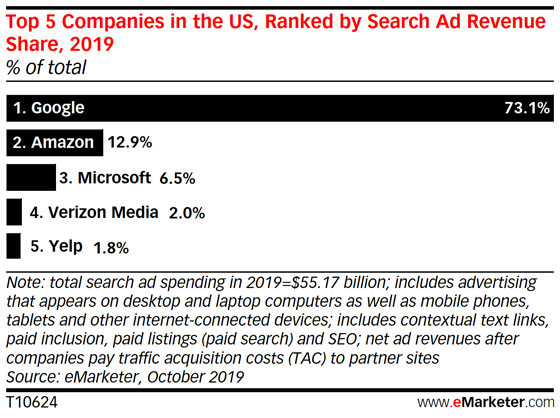

Overall, the ads market in the US is going to grow by about 18% this year reaching 55,17 billion dollars: Google now owns a slice of 73.1% (about 40 billion dollars), remaining by far the ruling player, but previsions for the upcoming years extimates a further decrease toward 70% of the market in 2021, already.

Amazon’s boom

Gaining ground and investments is now mainly Amazon, that will close 2019 with boom profits and also is the only big player that should have a growth trend projection in future years. Specifically, this year Jeff Bezos’ company saw ads investments increase by about 30% compared to 2018 and will probably overcome a total of 7 billion dollars, taking home a market quotation of 13% circa; already in 2021, though, the percentage should increase to a total 16%, with a final improving almost equal to the numbers lost by Google.

Right after bypassing Bing as the biggest ad search platform in the USA (with Microsoft’s search engine that stays still at 6.5% of the entire market), Amazon is basically setting up a running leap toward Google and its historic position.

Amazon’s ads strongest points

According to analysts, the strength of the eCommerce giant lies in its very nature and in the offered chance to advertisers to reach consumers directly during products’ query, a.k.a the exact moment they are ready to buy. On the contrary, with Google ADS the ads are simply shown in the result’s page based on query.

Furthermore, Inoltre, eMarketer principal analyst Nicole Perrin explained that “Amazon also implemented better gauging and targeting tools, making its channel more and more attractive to advertisers”, as well as providing profitable solutions like the program Amazon affiliations that we mentioned some time ago.

As mobile, Facebook is the real competitor

Things are rough to Google even on the mobile ads side, even if in this case Facebook is the direct competitor: this year Mountain View’s platform will gain back about 33% of all invested dollars on mobile online ads, with Facebook frog jumping on 30.8%.

Google’s countermoves and the new Shopping platform

Under this data’s light the value of the launch of the renewed Google Shopping is even bigger, now that it becomes a complete and multi-channel platform to buy and sell through websites, local shops or directly from Google. Very useful opportunities both to sellers and clients, that can further gain custom results based on surfing chronology ans previous shopping transactions: even now thousand retailers are already joining the Google’s cost-per-sale checkout program, and the company announced the mapping of over 2 billion products sold by local shops.

All in all, Google is actually counter-measuring its competitors attacks and even throws the gauntlet to Amazon: if Jeff Bezos’ company ate up quotes from the californian group both on ads investments and as products’ search engine, Big G is tackling it on the eCommerce side, trying to recover on a whole new frontier.