Google My Business, impressions and clicks drop due to Coronavirus

While Italy is bracing itself for the so called “phase 2” to contrast the spread of Coronavirus, data and statistics on the impact of the lockdown on the digital marketing market are starting to come from the United States. Reputation.com study focuses in particular on Google My Business, which is inevitably one of the products that has suffered the biggest drop in terms of impressions and clicks.

GMB and Coronavirus, what the american study reveals

The survey of the well-known Californian company of online reputation management – which is Google’s Premium partner – is based on the study of over 81 thousand listings on Google’s free showcase for local activities, in the United States and in different sectors, during the month of March.

Analysts have studied the effects of the pandemic on the system and, in particular, the impact on the key metrics of Google My Business, such as visualizations, clicks for directions on the map, clicks to call the company and click-through to websites.

A general drop for all fields

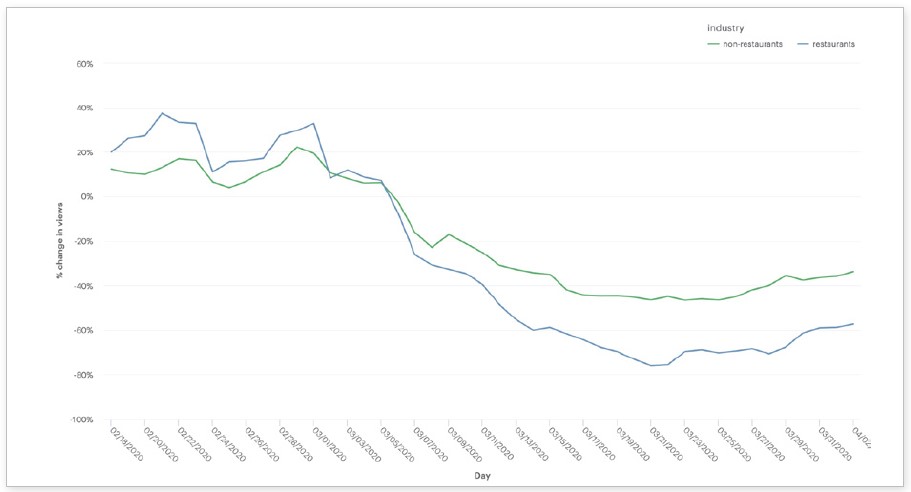

On a macroscopic level, the study found that in March impressions dropped by an average of 59% in all vertical sectors: up until March 5th, GMB views increased steadily in all sectors and in all regions, but when the pandemic started to hit the fan, there was a complete meltdown.

Given the nature of the service, it was obvious to think of such a situation: Google My Business is useful to connect users and stores (online, but also if not primarily, on a physical level), and in lockdown times and shutters lowered all around the world people have limited their exits to purchases of all kinds.

Another predictable remark is the drastic decrease for restaurants, obviously linked to the impossibility of eating out as it was normal until a few months ago.

The data on the click-to-actions in Google My Business

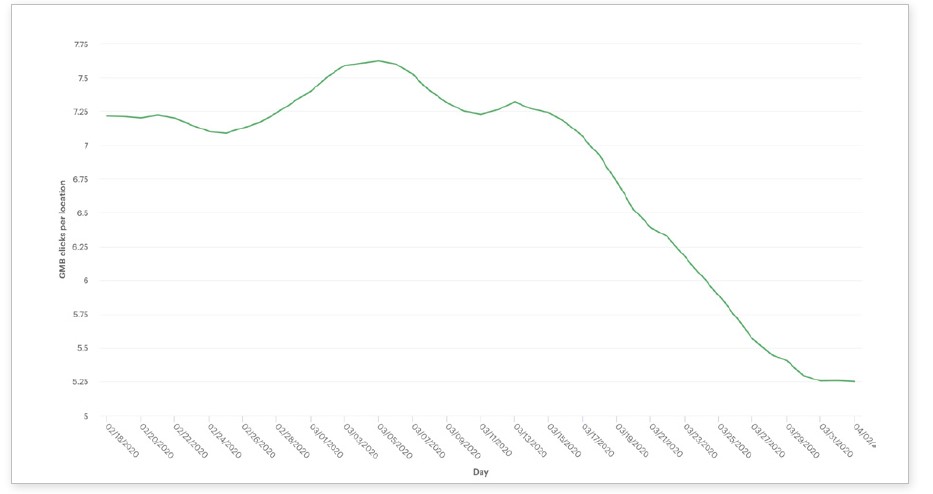

As also reported in an article from the Searchenginejournal, it is not only the statistics relating to impressions to point downwards: all click-to-action of GMB cards also decrease, with an overall average of 37%.

This segment includes the three modes of interaction with the card: clicks to driving directions, clicks to websites and clicks to call a business, a.k.a respectively the clicks to obtain directions, the clicks to call the phone number of the company and the clicks that referring to the website.

Less travels, more phone calls

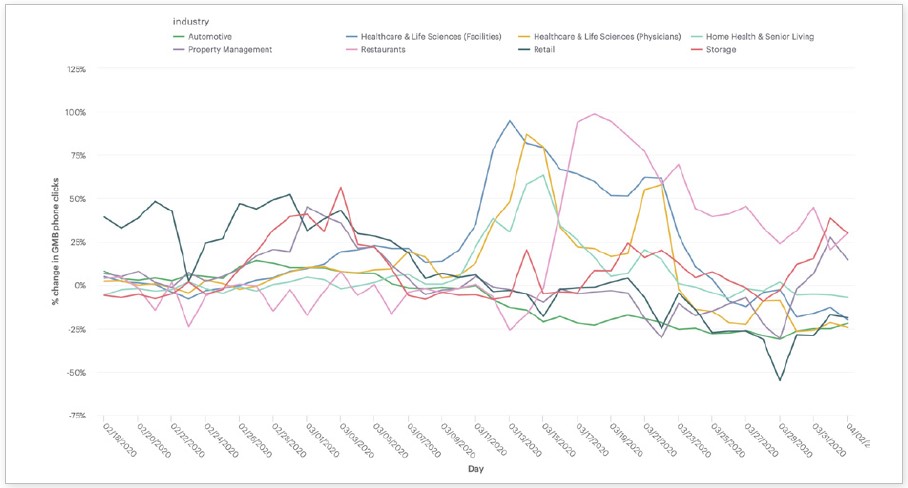

The sharp drop in clicks to get directions on the map (less than 60% in all vertical sectors) is certainly due to the effects of travel restrictions imposed in the United States; research notes that this figure has reached the bottom, interpreting this as a sign that people have quickly understood which are the essential enterprises that remain open and reachable and which instead fall within the scope of ancillary services and are therefore closed.

Another element that should not be overlooked is that – even in a context of decline – clicks that start a phone call have suffered a less dramatic impact (less than 21%); so to say, for some sectors such as financial services the volume of calls has even increased. These data suggest that people are still interested in activities even if they can’t physically reach them, and so they use the phone to get in touch with the company and get information or make sure of the opening times during the emergency.

Clicks toward sites also drop

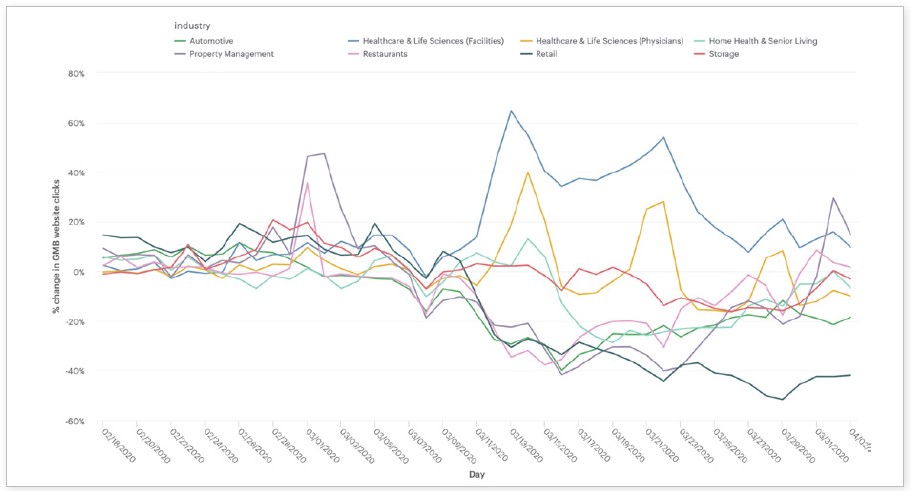

The volume of clicks that Google My Business direct to corporate websites is also going down: on a general level, the average decrease is 31% in all sectors, but with very different performance depending on the type. In particular, retail suffers the strongest impact (close to 40%), while for other activities there is an increase, probably due to the need and urgency to request information.

It also applies to restaurants: the study reveals that the GMB boards of catering businesses in the United States in March brought about 10% more clicks to sites than in previous weeks, probably because the customers were interested in understanding the policies regarding closing, checking the news or figuring out how to order home delivery.

Recovery signs for activities

The study closes with a message of hope for companies (not only US ones): although the COVID-19 pandemic has shaken the GMB lists for activities in all sectors, we are seeing signs of a gradual reversal of the trend.

Even automotive and retail – two activities absolutely shaken by the emergency – are showing signs of a recovery in performance on GMB. Right after undergoing a rapid decrease throughout the month of March, the clicks for car dealerships seem to have reached the bottom and show a first, timid increase. However, it is important to know that different containment rules have been applied in the United States, with restrictions that in some countries have not affected car dealerships, which have also remained open for sales and service.

More complex the performance analysis of the retail trade, which has suffered a free fall in March followed here too by a small reversal: according to analysts, it is possible that people are again showing interest in shopping, having also learned to use and appreciate the eCommerce. So, now they “might click more often to visit a retailer’s website to make an online purchase, and then eventually click on the guidance if they want to pick up a purchase in a store”.

The case of restaurants

The report dedicates a special space to catering activities, which have faced unique challenges: while the pandemic spread throughout the United States with the consequent lockdown ordinances, people have had to adapt their lives also concerning the food theme.

“At first it was not always clear that it was possible to order deliveries from a restaurant, or if the restaurants themselves were open”, they write; over time, users have “started calling restaurants to order food and maybe that’s why the clicks for phone calls from GMB began to rise in the middle of March”.

However, at the end of March there was a new decline in this parameter: probably, people had obtained the necessary information, adapted to online orders directly through sites or saved the number of their favorite restaurant, bypassing Google.

In addition, still in the same period there is a slight rise in impressions on the GMB cards for catering activities, which have started to update their profiles with specific information on work management during the emergency, thus making GMB cards valuable sources of information again.

Conclusions: Google My Business is still a privileged channell

This study represents an interesting source of information also for other markets (the data on oscillations tell the same reality that emerges from our study on the Covid-19 impact on organic researches) and confirms, if ever there was need, the value of Google My Business tabs for local SEO.

Regardless of the sector or the geographical area, “it is essential to manage the GMB profile at its best“, they write from Reputation.com: people continue to use this service to know the activities and get in touch with them even during the pandemic and the data prove it. Customers who are interested in a company – who perhaps cannot physically reach the actual store – tend to interact by calling or visiting their website.

Now more than ever then it is necessary to verify in order to provide precise, updated and fully informative contents to be ready to intercept the new requests of users, destined to rise with the start of this Phase-2. This also means updating the website and ensuring that calls can still be answered, meeting the new customer needs.