Strategic company sites, seasonality and interactions for the business

December is a month traditionally full of researches, statistics and balances devoted to all the trends of the ending year, and even the SEO world makes no exception. Straight from the US here it comes an interesting study describing the ratio between consumers and business sites, with useful indications to whoever works on the SEO optimization of business projects.

Business sites and clicks, a study about trends in the United States

The investigation has been made by Yext, an american company working on the online brand management field, and reveals that consumers are turning more and more interactive with the search results correlated to business sites, as we already said in the article about the impact of the Google’s SERP features on users’ habits.

The three most interesting points of the study

The data gathered by the study carried out on a sample of over 400.000 business SERPs in the US draw out three main elements:

- Consumers are gettin more and more active in search: Consumer actions in business listings grew of the 17% over the past year, like with driving directions clicks, clicks to call businesses, and more.

- Research and researchers are getting better: over the past year, consumer actions grew faster than search impressions of business listings (10%), suggesting that customers are finding what they want faster. So customers are spending less time searching and more time engaging with businesses, and this can depend both on the ever growing people’s familiarity with Google Research and their use of more specific queries, or on the better ability of search engines to understand said queries.

- Reviews are on the rise: Consumers are leaving more feedbacks about businesses. Review count per business location grew 27% over the year, and especially financial services review volume grew 91% per location, the fastest growth of any other industry. Businesses are getting savvier about the importance of reviews as well, responding to reviews 47% more than the previous year, and the higher probability of being read and answered can encourage people to write.

Understanding seasonality to enhance performances

Alongside the current picture of the business sites’ situation, Yext also tried to outline the main trends expected on 2020; as Zahid Zakaria says, the company’s Senior Director of Insights and Analytics, “Some industries are naturally more popular with consumers during certain seasons, but the need for businesses in every category to be in control of their facts online stays important year-round”.

What still is fundamental is “to capture the wave of customers who are interested in transacting with them, no matter what month it is”, and in this perspective businesses should be ready “by ensuring their information is accurate across channels, from the search results on their own website to their listings on third-party platforms”.

Seasonality calendar in the United States

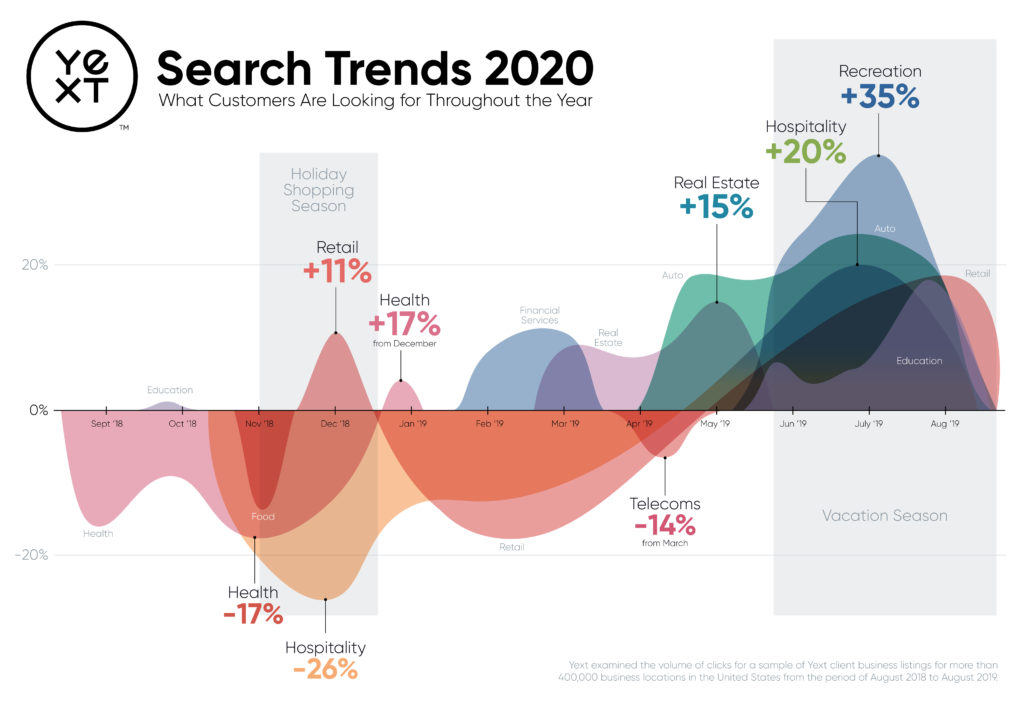

Here then follows the calendar of seasonality trends for business sites in the US (the image above is taken from yext.com site):

- January: watch your health. With New Year’s resolutions fresh on their minds and cold and flu season at its peak, americans start the year off with visits to the doctor; in January, healthcare organizations see a 17% increase in clicks compared to the previous month.

- February: watch your wallet. In February and March tax season is well underway: consumers engage with financial services institutions up to 11% more than the annual average.

- March: open house. Spring time is a period of renewal for homes as well: real estate agency ads for house hunting and selling see a 22% average increase from February to May.

- April: the end of the phone bubble. The wave started in the winter of consumers picking up the latest high-profile smartphone upgrades from the fall has subsided: clicks to phone carrier and telecommunications provider listings in search drop 14% compared to the month before.

- May: engines on full throttle. Consumers look to capitalize on Memorial Day sales and revamp their rides in time for summer : clicks to automotive service search listings increase 18% compared to the annual average.

- June – July: time for some fun. Over the summer months users think about outdoor recreational activities: results for recreation and entertainment listings online, including theaters, sports venues, nightlife, and more, see an increase of 35% relative to the annual average. Clicks to hotel listings also bump up to 20% above the annual average during this time due to summer travel.

- August: back to school. School is just around the corner and parents and students are not just stocking up on clothes, school supplies, gadgets, and other necessities, but also getting their cars in shape: compared to the annual average, clicks to automotive service listings reach 21% more, Clicks to listings for stores spike to 18% and educational services, like tutors and libraries, see an increase of 18%.

- September: falling back into habit. Americans wrap up their vacations and return to their school and work routines, hence clicks on recreational and entertaining activities noticeably drop (18% below the annual average), reaching their lowest point in November (under 25%).

- October: heads on books. The school year has started and families get serious about grades and school performances again: clicks to listings in the education category see a nearly 10% jump relative to September.

- November: hosting dinners. During Thanksgiving month, clicks to restaurant listings drop 13% below the annual average, sign that users prefer to eat at home.

- December: home for the Holidays. In the US as well users celebrate their holidays with their families and prefer to stay home for the night: that is why organic clicks to hotel listings fall to 26% below the annual average.

- December & January: the season of giving and buying. Americans’ shopping for holiday gifts in December drive clicks to retail listings 11% more than the annual average, but already in January consumers take a break from spending and recoup their savings (and clicks plummet an average of nearly 25%).